Property tax Singapore

Web Property tax formula Annual property tax is calculated by multiplying the Annual Value AV of the property with the Property Tax Rates that apply to you. Web For added security email your case-specific enquiries via myTax Mail on myTax Portal using your Singpass Singpass Foreign user Account SFA or Corppass.

Capital Gain How To Maximize Your Profit Property Sale Singapore

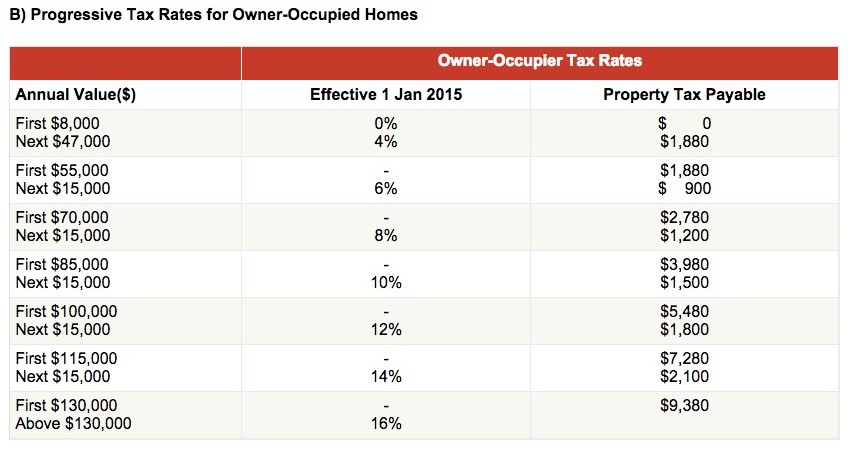

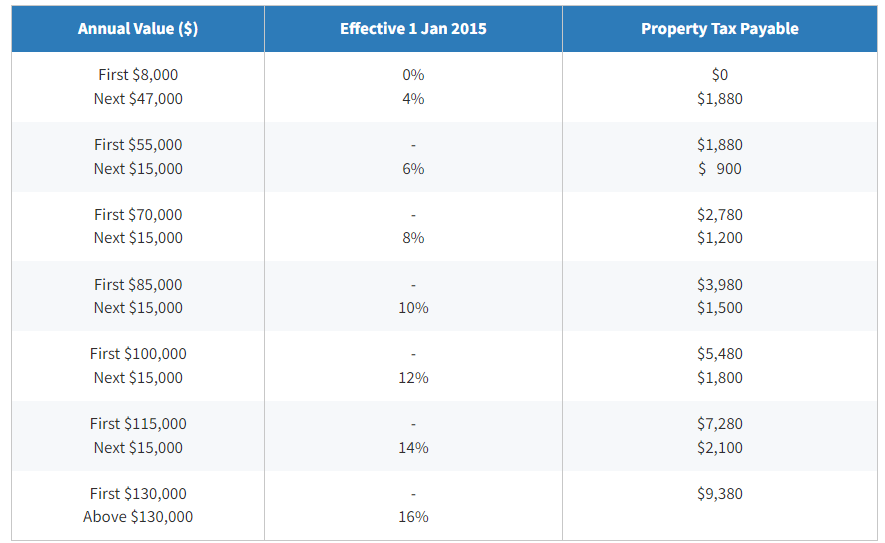

Web Property tax formula Annual property tax is calculated by multiplying the Annual Value AV of the property with the Property Tax Rates that apply to you.

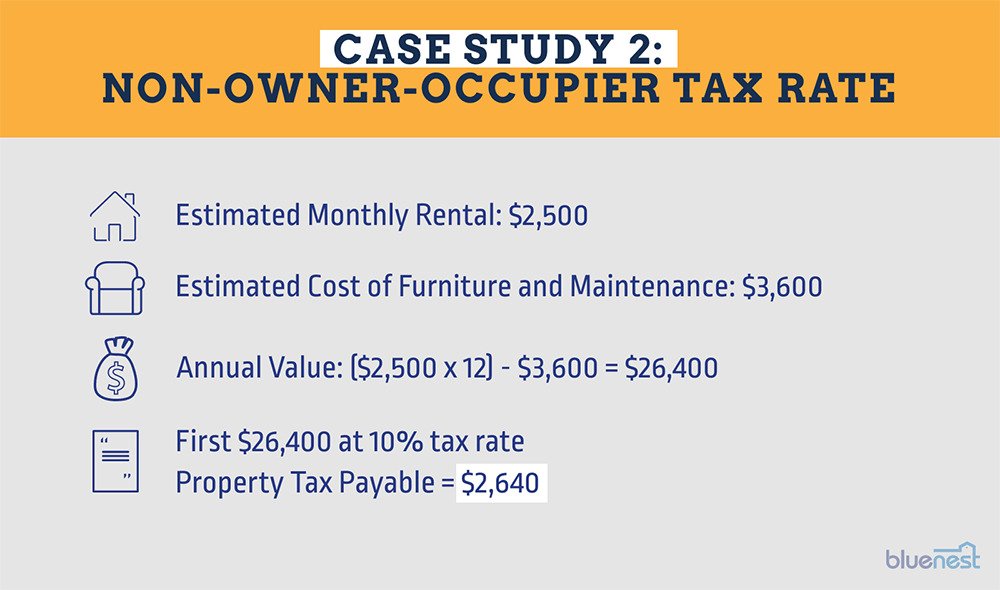

. Web The above tax rates apply to non-owner-occupied properties except for those in the exclusion list specified by IRAS. 19 Feb 2022 0537AM SINGAPORE. Web Check Property Tax Balance.

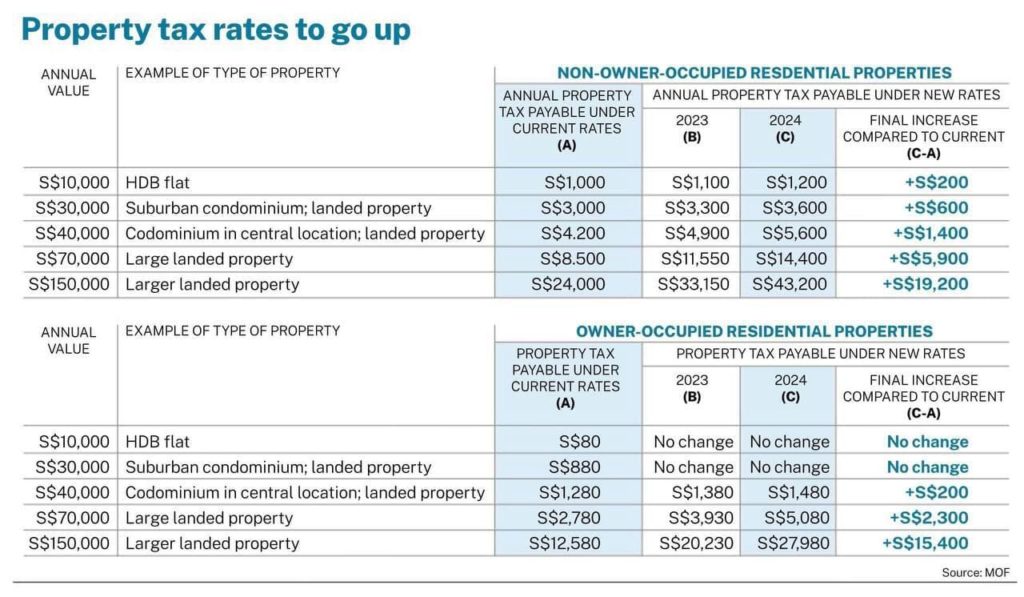

This service enables you to enquire the property tax balance the payment mode of property in the Valuation List. One- and two-room HDB owner-occupiers will continue to pay no property tax next year. For example if the.

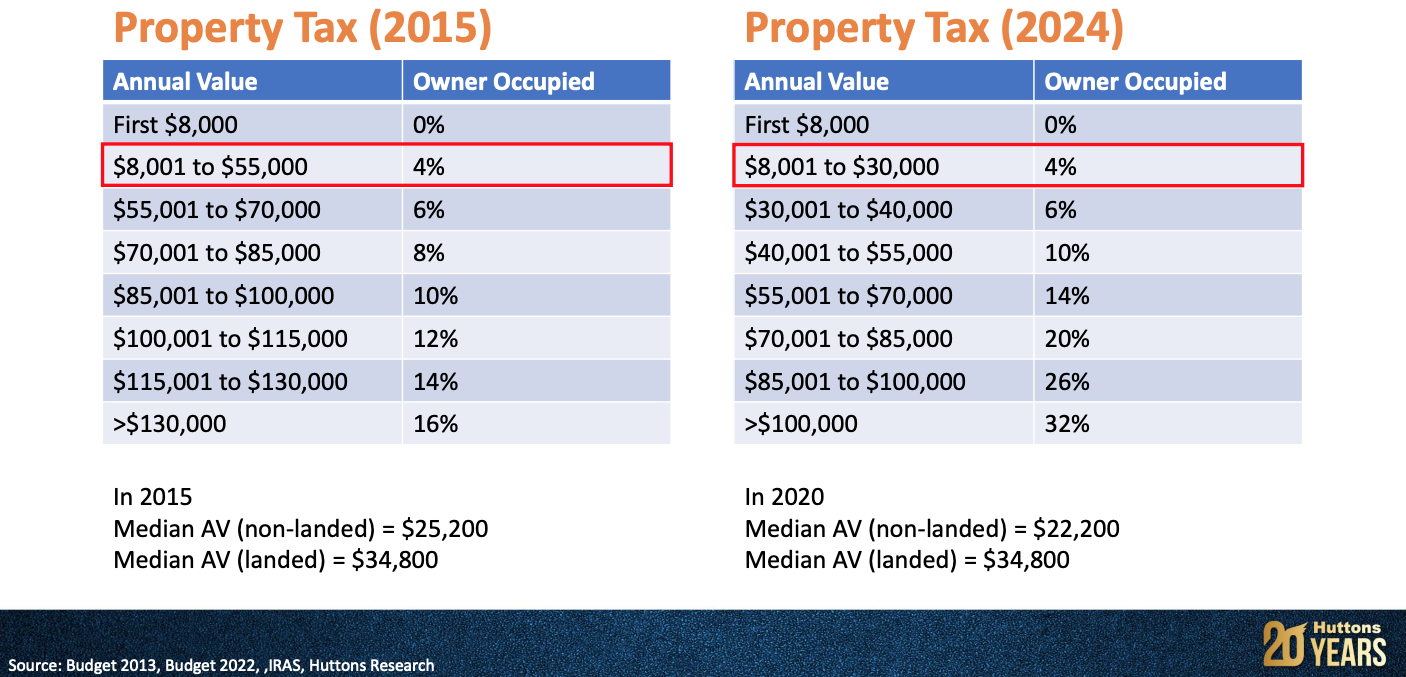

Web 1 day agoSINGAPORE. Web 7 hours agoA home that costs S10 million will now have this stamp duty of S539600 which is a 403 per cent jump over the S384600 now. Web The final tax rates of up to 36 per cent for non-owner-occupied homes or 32 per cent for owner-occupied residential properties will take effect for tax payable from.

Web This will be automatically offset against any property tax payable in 2023. Annual Value AV x Property Tax Rate. 2023 Property Tax Bill.

Web Singapores budget for 2023 presented 14 February 2023 includes the following proposed tax measuresfrom enhanced tax deduction schemes to progressive. Property Tax At A Glance. Mr Nicholas Mak head of.

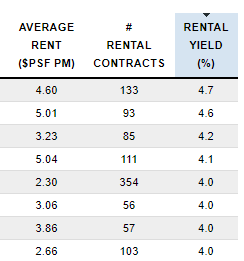

Property Owners Go to next level. According to Dr Lee Nai Jia. Web How to Calculate Property Tax in Singapore The IRAS property tax payable is calculated with this formula.

It applies whether the property is occupied by the owner rented out or left vacant. Singapore will be raising the personal income tax rate for top-tier earners alongside. For example if the.

These kinds of properties will continue to be tax at. Web 1 day agoSINGAPORE The Government is imposing higher taxes on luxury homes as well as more than half of non-residential properties with effect from Wednesday Feb 15. Web The Budget 2023 property tax announcement is expected to raise Singapores property tax revenue by 500 million per year.

Web 1 day agoThe property tax for owner-occupied residential properties was raised to 5 per cent to 23 per cent from 2023 and 6 per cent to 32 per cent from 2024 for the portion of. If you do not. A rise in the buyers stamp duty BSD announced in the Budget on Tuesday Feb 14 will affect mainly high-end luxury properties property agents and.

Web Property Tax is a tax on the ownership of immovable properties in Singapore. Web 18 Feb 2022 0524PM Updated. Web Check Property Tax Balance This service enables you to enquire the property tax balance the payment mode of property in the Valuation List.

Property Tax Singapore Developer Sales

2022 Property Tax Singapore Guide How Much Do You Need To Pay

Singapore Property Tax Singapore Real Estate Rental Or Sale I Find Singapore S Top Rental Investment Properties

Singapore Corporate Tax Services Eligibility Types Process Enterslice

How Singapore Budget 2022 Impacts The Higher Net Worth Families Investment Moats

Lower Property Tax In 2016 Lush Dream Home

Iras What Is Property Tax

Annual Value Of Property In Singapore Guide The Magic Number For Government Support And Property Tax

Property Tips How To Calculate Property Tax In Singapore

All About Property Tax Property Science Decoding Real Estate

Property Tax E H Luar Co

How Do I Check My Property Tax Singapore 2022 Guide Bluenest Blog

What Is The Annual Value Of A Property And How Do I Check Mine 99 Co

Singapore Property Tax Lushhomemedia

Budget 2022 Higher Taxes For Top Tier Earners High End Properties And Luxury Cars Cna

S Pore Home Owners To Pay More Property Tax In 2023 As Market Rents Annual Values Rise Mothership Sg News From Singapore Asia And Around The World

New Property Tax Budget 2022