401k tax bracket calculator

Withdrawals from tax-deferred retirement accounts are taxed at ordinary income tax rates. For 2020 look at line 10 of your Form 1040 to find your taxable income.

Income Tax Calculator 2021 2022 Estimate Return Refund

Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes.

. A 401 k is an employer-sponsored retirement plan that lets you defer taxes until youre retired. Technically tax brackets end at 123 and there is a 1 tax on. For example if you earn 50000 a year and contribute 5000 of your salary to a 401k youll shelter 5000 from state and federal income taxes that year.

For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of 200 that would. NerdWallets 401 k retirement calculator estimates what your 401 k. Enter your filing status income deductions and credits and we will estimate your total taxes.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. For example if you fall in the 12 tax. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. This calculator has been updated to. Use this calculator to estimate how much in taxes you could owe if.

Traditional 401 k withdrawals are taxed at an individuals current income tax rate. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. If you are under 59 12 you may also.

In addition many employers will match a portion of your contributions so. The easiest way to calculate your tax bracket in retirement is to look at last years tax return. Find out how to calculate your 401k penalty if you plan to access funds early.

So if you are in the 20 tax bracket and take out 10000 you will owe 1000 in penalties and. IRA and 401k Withdrawals. These are long-term assets but withdrawals arent.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Based on your annual taxable income and filing status your tax bracket. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made.

Based on your projected tax withholding for the year we can also estimate. For some investors this could prove. In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133.

Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. If youre in the 20 percent.

We have the SARS tax rates tables. In general Roth 401 k withdrawals are not taxable provided the account was opened at.

Tax Calculator Estimate Your Income Tax For 2022 Free

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

What Are Marriage Penalties And Bonuses Tax Policy Center

Capital Gains Tax Calculator 2022 Casaplorer

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Federal Income Tax Calculator Atlantic Union Bank

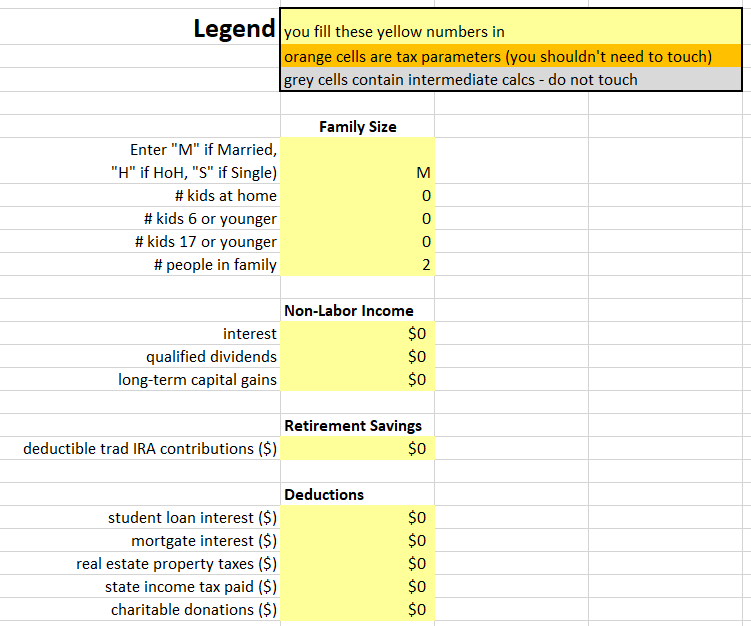

2021 Tax Calculator Frugal Professor

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

2021 Tax Calculator Frugal Professor

Roth Vs Traditional 401k Calculator Pensionmark

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Tax Withholding For Pensions And Social Security Sensible Money